If you've been on the sidelines to buy a home, 2024 is looking better for you.

After a year full of record-high interest rates and home prices, experts are seeing signs of improvement for the housing market in 2024.

With interest rates slowly going down, there is a little more wiggle room in people’s budgets to own property.

“Last year, for first-time home buyers specifically, it was rough. Affordability, on top of a lack of inventory, have been our biggest issues in the real estate market for DFW,” said Ann Andrews, a realtor with Dave Perry Miller Real Estate and an advanced historic home specialist.

Get DFW local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC DFW newsletters.

“With interest rates having crept up into the sevens and even low 8%, you lose that buying power a lot of times. So what happened is, we saw a lot of buyers just kind of sit on the sidelines for the last 12 to 18 months.”

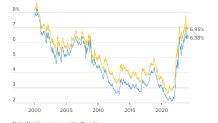

According to new data from Freddie Mac, the average mortgage rates dropped below 7% in December for the first time since August. The rates peaked at 8% peak in October, which pushed housing costs to the highest level since 2000.

In fact, rates were high enough to affect the rental market. Homes were 52% more expensive than rentals this year, according to the 2023 Zumper Annual Rent Report. That's the highest gap on record. The same report also says high interest rates deterred more than 69% of renters from buying a home last year.

Local

The latest news from around North Texas.

For renters looking for a light at the end of the tunnel, the interest rates for mortgages are expected to improve even more in 2024.

“The Fed has said that they're planning three different times for the rates to drop this coming year. So we're going to see the rates come down – and with that comes demand,” warned Andrews.

That’s the catch. With that drop comes another homebuying frenzy like we've seen before – similar to when the rates dropped to historic lows during the pandemic. Bidding wars, low inventory and high demand were the norms for the last two years – until the Federal Reserve hiked the interest rates back up in an effort to battle inflation post-COVID.

“What we're worried about is again going back to the inventory, that problem of not having enough inventory. So that's something that we're going to have to wait and see on,” said Andrews. “[The bidding wars] can drive up the cost of the home and then there goes any savings you had hoped for and to be able to leverage – to even potentially buy down an interest rate point.”

With rates expected to drop in 2024, Andrews said the next 30 to 60 days is a sweet spot for homebuyers to take advantage of.

“We haven't really seen that crazy uptick that we usually see come spring just yet. Get in and get the home you want before you start seeing bids and multiple offers all over again. And I hope that's not what's going to happen but you never know,” she said. “I'm truly hopeful that it doesn't get that crazy as it was in 2021 and 2022.”

The same goes for sellers. Lower rates mean those selling a home will have better options after the sale is done.

“Sellers also have been sitting on the fence thinking, ‘Well, should I sell right now? Are we going to have a recession? At the end of the day, if we're starting to see interest rates drop down a little bit, a seller usually turns into a buyer – they're going to have to buy something else, so it just all coincides together.”

Andrews said with this transitional period between interest rates lowering and the spring buying season still months away, homebuyers might be able to negotiate some deals within home prices.

"So right now, with the market being a little more quiet – there's a lull. And as a buyer, you can leverage by asking for repairs that are necessary,” she said. “It's something that I call the 'Big Five' -- roof, foundation, electrical, HVAC and the plumbing. Those are big five very expensive and costly things that a lot of times buyers need to have working when you buy your first home."

Andrews said homebuyers can leverage and negotiate those repairs or get some concessions in lieu of repairs.

“I think it's important to try to get in there now instead of waiting until the market does a shift like we’re expecting. And when you're up against three or four buyers, a seller is not going to be incentivized to give you anything,” she said.

Some final food for thought -- the National Association of Realtors forecasts mortgage interest rates will average 6.3% and estimates 0.9% increase in home prices in 2024.