- "The charts, as interpreted by the legendary Larry Williams, suggest that inflation might cool down faster than most money managers anticipate," CNBC's Jim Cramer said.

- The "Mad Money" host explained that it could mean the stock market surpasses performance expectations.

Longtime technician Larry Williams believes the stock market may have a stronger 2022 than many Wall Street forecasts, CNBC's Jim Cramer said Wednesday.

"The charts, as interpreted by the legendary Larry Williams, suggest that inflation might cool down faster than most money managers anticipate, which would mean that 2022 ... could be a much better year for the market than we're expecting," Cramer said.

Get DFW local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC DFW newsletters.

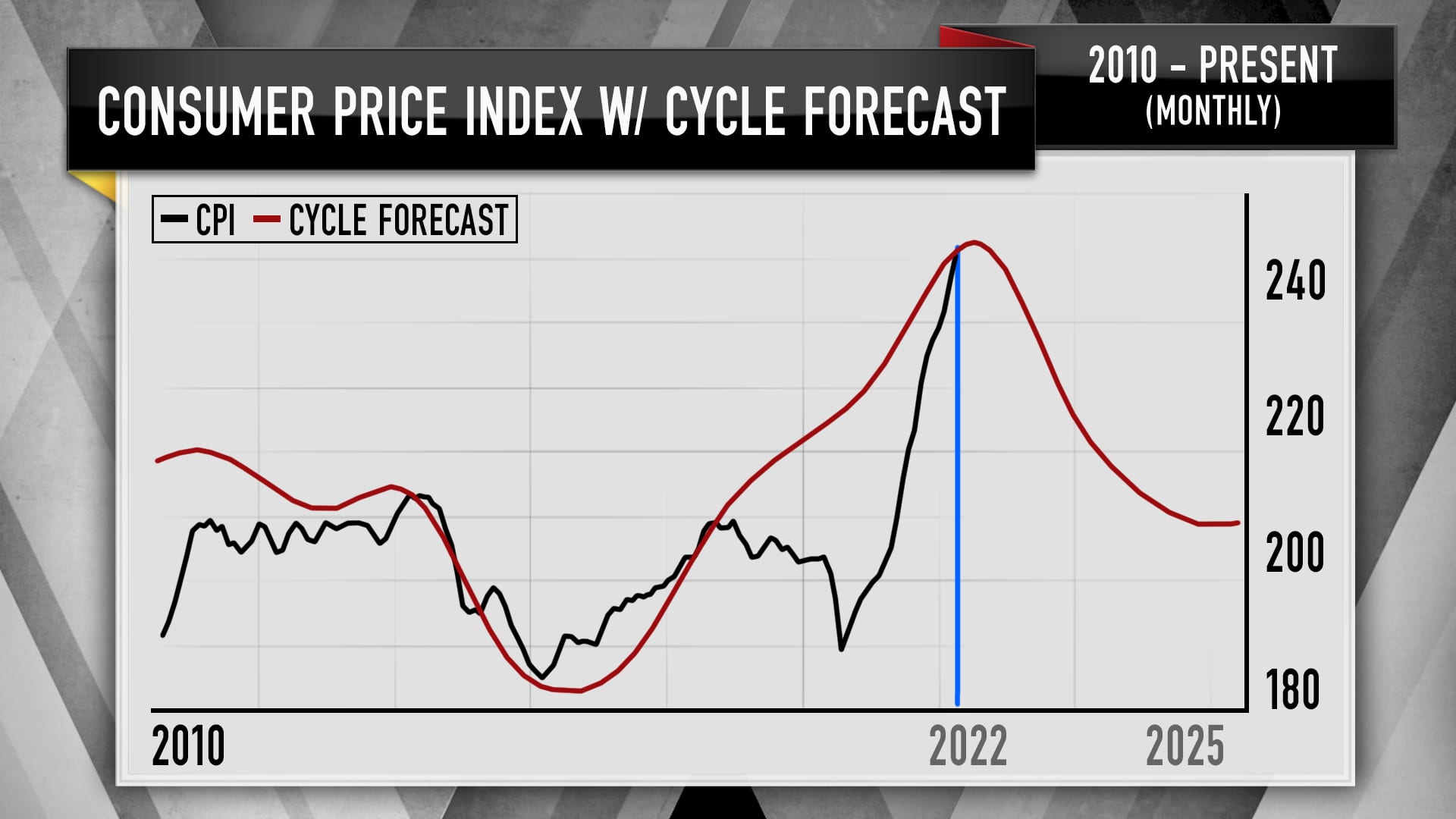

The "Mad Money" host said that Williams, who frequently uses historical data to create cycle forecasts, believes that inflationary pressures in the U.S. "should already be peaking." While Cramer cautioned that Williams' cycle forecast for the Consumer Precise Index isn't a precise timing tool, he said it's worth considering.

"In his view, [the first quarter] should be really last really bad quarter for inflation," Cramer said. If Williams is correct, Cramer said there will be implications for the stock market because it may mean the Federal Reserve does not need to tighten monetary policy as aggressively as expected.

Money Report

"That's not the only reason Williams is bullish on stocks in 2022," Cramer stressed. Another reason for Williams' positive outlook can be found in the decennial pattern, which refers to average market returns based on the last digit in a particular year.

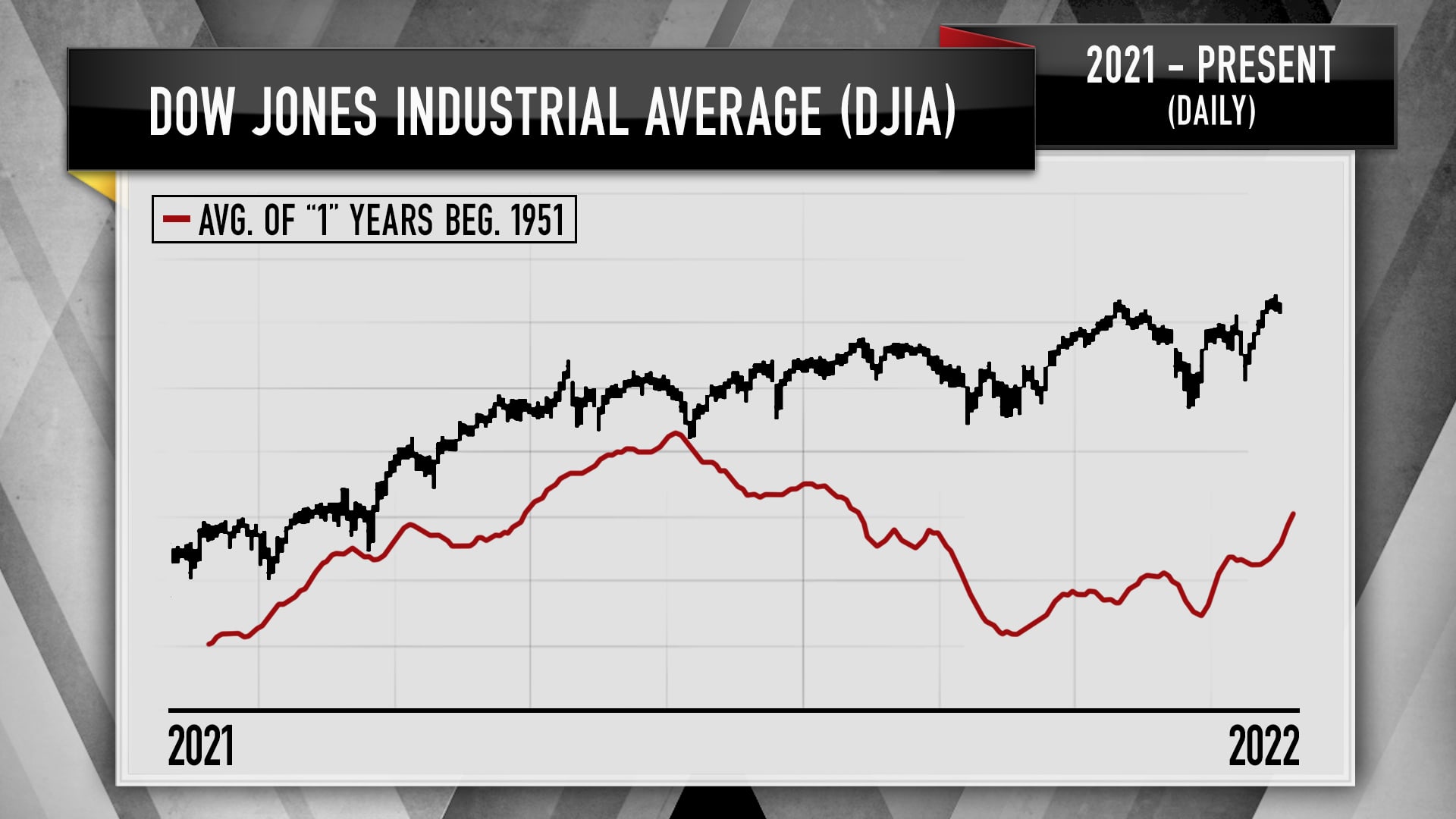

Looking at the average of years ending in "1" compared to the Dow Jones Industrial Average's actual trading in 2021 proved to be a "pretty helpful guide" last year, Cramer said. "You have to ignore the magnitude and just look at the direction of the moves," he said.

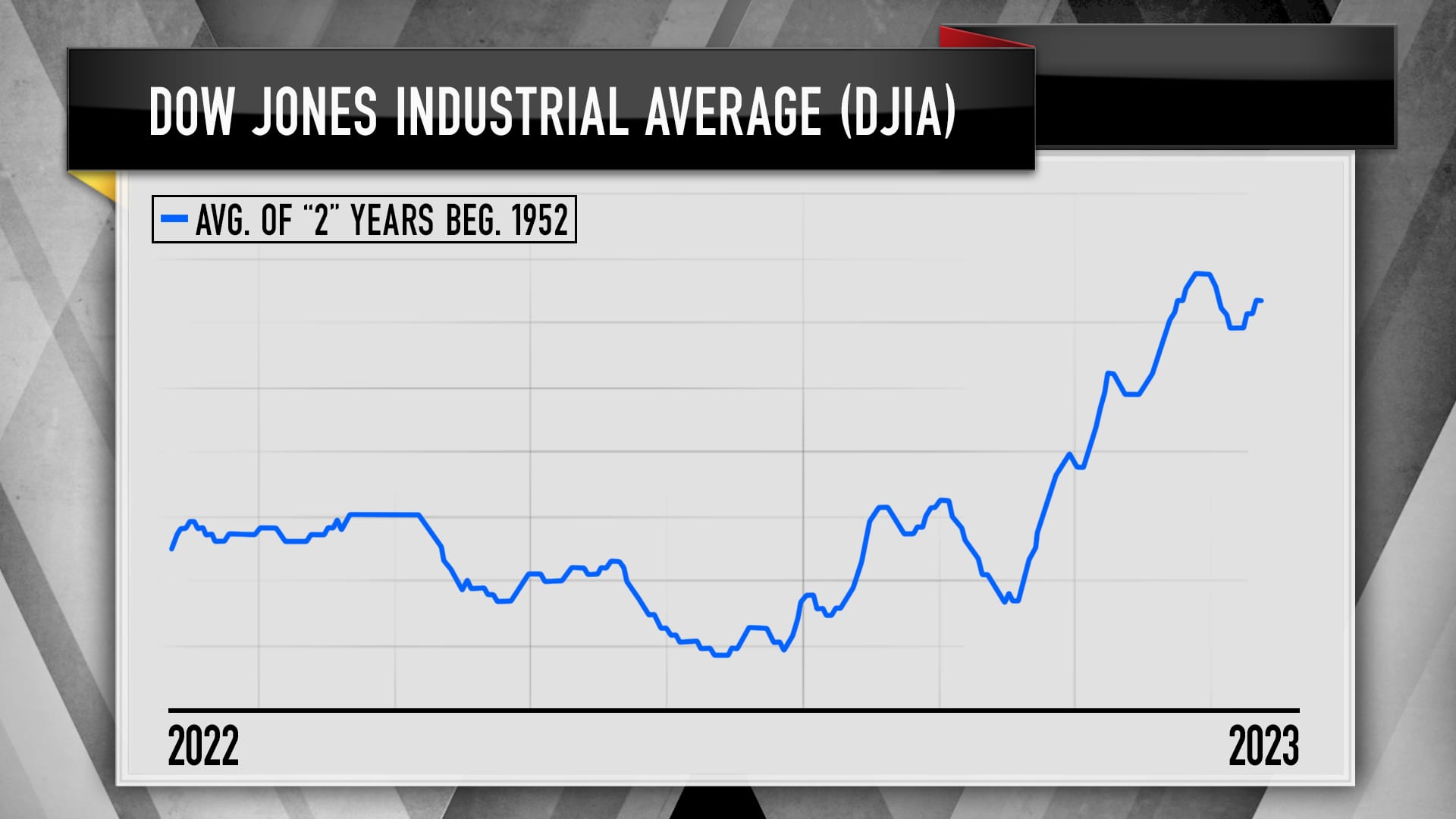

Williams finds that the decennial pattern for years ending in "2" indicates 2022 could be a pretty choppy year for the Dow, according to Cramer. In particular, there's been a "substantial low" expected to hit stocks in June or July, he said.

"Then you tend to get another terrific buying opportunity around September, with the market tending to take off in the fourth quarter," Cramer said. "Williams also points out that, historically, in years ending in the number '2,' you want to buy into any major sell-off" because usually the market has a solid year, Cramer added.

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Disclaimer

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com