- The first estimate for third-quarter annualized GDP growth is expected to show an increase of just 2.8%.

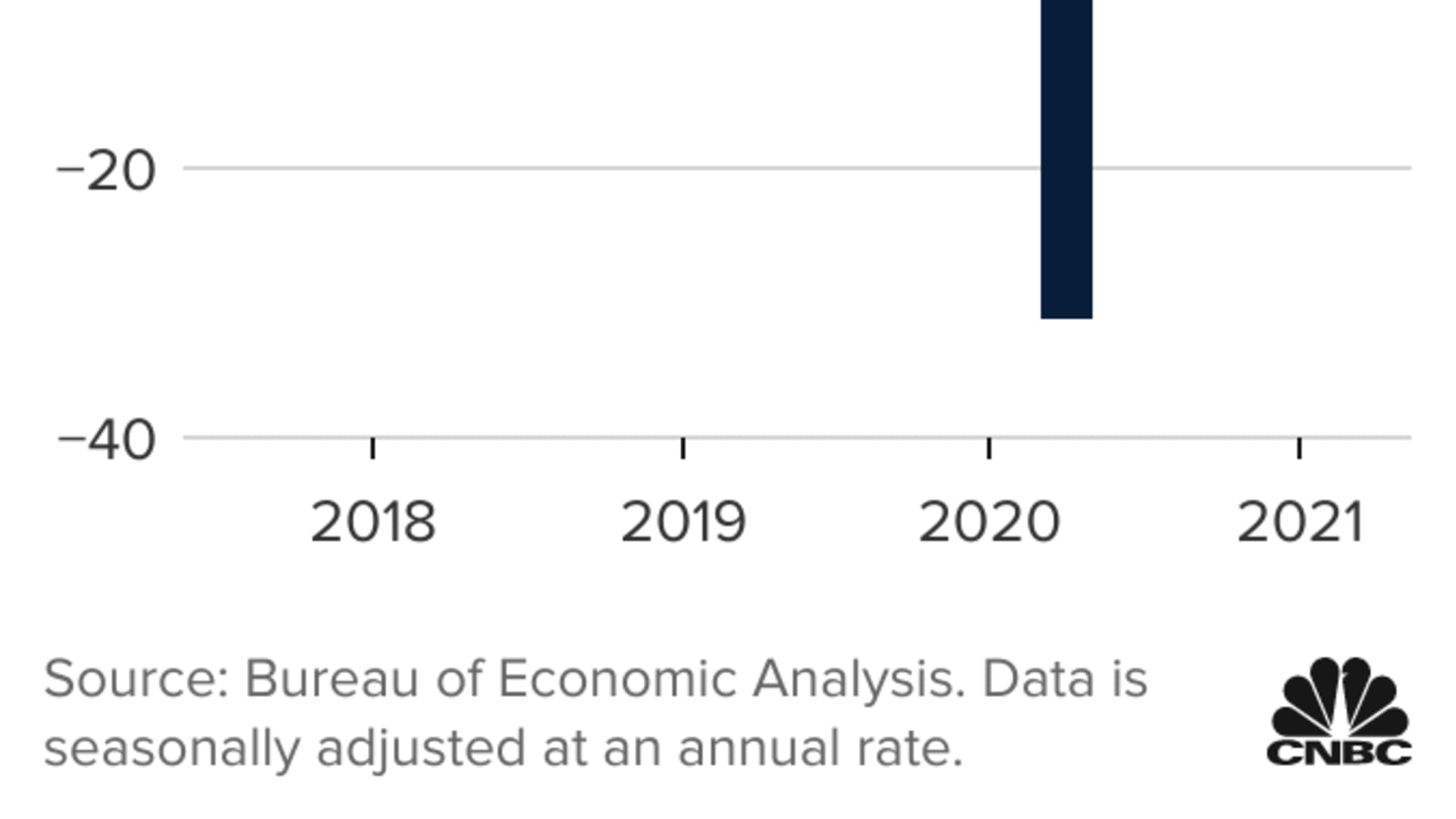

- That would be the slowest pace since the recovery began in April 2020 off the shortest but steepest recession in U.S. history.

- Economists aren't worried. They largely say the slowdown is the result of factors, principally related to supply chain bottlenecks.

The U.S. economic recovery slowed sharply in the previous three months, as products remained stranded at normally bustling ports, employers struggled to find workers and consumers battled with rising prices.

When the Commerce Department releases Thursday its first estimate for third-quarter annualized gross domestic product growth, it likely will show an increase of just 2.8%, according to Dow Jones estimates.

Get DFW local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC DFW newsletters.

While that kind of number would have seemed perfectly fine in pre-Covid times, it actually would be the slowest pace since the recovery began in April 2020 off the shortest but steepest recession in U.S. history.

Moreover, there's a chance the economy didn't grow at all in the quarter — the Atlanta Fed's GDPNow tracker lowered its estimate to 0.2%, with the most recent downgrade the result of a lowered outlook for government spending and real net exports.

Money Report

Economists aren't worried, however. They largely say the slowdown is the result of factors, principally related to supply chain bottlenecks, that will ease in the months ahead and allow the recovery to continue.

"The weakness is a function of supply distortions more than anything," Natixis chief economist for the Americas Joseph LaVorgna said. "The economy is still fundamentally strong, and I wouldn't look at this one quarter of being reflective of where we're going."

Natixis, in fact, has a slightly rosier outlook on the number for GDP, which is a sum of the goods and services the economy produces. The firm sees growth coming in at a 3.3% pace. Still, that would be down sharply from the 6.7% increase in the second quarter. It would also be the lowest figure since the staggering 31.2% plunge in the pandemic-scarred second quarter of 2020.

"To the extent that we haven't fully reopened, at least in terms of travel and leisure activities, things are healthier than what they seem," LaVorgna said. "I don't look at this as a sign of things to come."

CNBC's Rapid Update survey of forecasters indicates median growth expectations of 2.3% for the third quarter.

Still, the economy faces multiple challenges.

Dozens of ships are stuck at jammed California coast ports, waiting to deliver some $24 billion of goods, according to a recent Goldman Sachs estimate. The bottlenecks are the result of outsized demand for goods over services at a time when companies are having a hard time filling vacant positions. A record 4.3 million workers left their jobs in August, leaving the economy with 10.4 million employment openings, according to the Labor Department.

There's dim hope that the supply chain issues will work themselves out anytime soon. A recent Dallas Federal Reserve survey showed 41.3% of respondents think it will take at least 10 months for supply chains to return to normal, and 64.5% of Texas firms said they've seen disruptions or delays with supplies, up from 35.5% in February.

Other economic issues

Those problems are in turn triggering a run on inflation that is near its highest point in 30 years as goods become more scarce and costs of materials continue to rise.

LaVorgna said he worries about the potential for swelling energy costs to thwart growth in the future.

"Production is still about 15 to 20% below where it was pre-pandemic," he said. "The recipe for higher energy costs is very present. That's what will hurt the economy even more than the supply chain issues will."

In the meantime, expectations for growth have been recalibrated.

Goldman Sachs has lowered its GDP outlook several times, and took it down further Wednesday for the third quarter to 2.75%. The firm has ratcheted down its 2021 and 2022 full-year outlooks to 5.6% and 4%, respectively, from already-lowered estimates of 5.7% and 4.4%.

Federal Reserve policymakers are contending with the concurrent forces of slowing growth and rising inflation, raising comparisons to the stagflation of the late 1970s and early 1980s. Traders have upped their bets to when the Fed will start raising interest rates again, with the fed funds futures market now anticipating the initial hike in June 2022 and at least one more before the end of the year.

However, most economists dismiss the likelihood of stagflation, instead expecting a more normal set of circumstances to prevail.

That would mean a considerable acceleration of GDP in the fourth quarter followed by a 2022 that would start to resemble the pre-pandemic U.S. economy. Jefferies economists, for instance, see the third quarter coming in at a 3.8% growth rate before giving way to an 8% burst to end 2021.

Citigroup is looking for just 2.4% in third-quarter growth, but economist Veronica Clark noted that "the slower pace can broadly be summarized as a result of supply-side constraints as opposed to a reflection of softer demand."