- Starbucks said quarterly same-store sales growth of 91% in China — up from a contraction last year — missed expectations.

- Less than four months into 2021, Beijing-based business data company Qimingpian counts 14 fundraising deals in China's tea and coffee market. That's the same number as the country saw for all of 2019 and just shy of last year's total of 19, the data showed.

- "Entry of new competitors to the specialty coffee market in China" was one of the business risks Starbucks listed in its annual report filed in November.

BEIJING — Investors in China are stepping up their bets that locals will buy more beverages that aren't from Starbucks.

The American coffee giant counts China as its fastest growing market and largest outside the U.S. While a quarterly earnings report Tuesday showed steady expansion, Starbucks said same-store sales growth of 91% in China — up from a contraction last year — missed expectations.

The company attributed the miss to unexpected pandemic-related travel restrictions.

Get DFW local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC DFW newsletters.

But the market is heating up as investors have their eye on another trend: home-grown beverages.

Less than four months into 2021, Beijing-based business data company Qimingpian counts 14 fundraising deals in China's tea and coffee market. That's the same number as the country saw for all of 2019 and just shy of last year's total of 19, the data showed.

These deals include investments in Hey Tea and Nayuki, tea-based beverage companies that have each reportedly reached valuations of about $2 billion or more in the last several months. Foreign brands illycaffe and Tim Hortons are also raising money for their local ventures.

Money Report

Precise investment figures for the industry were difficult to pin down given the private nature of many of the deals, but different data sources all pointed to significant growth.

In December, Chinese business news site 36kr reported that Shanghai-based Manner Coffee received another round of investment that valued it at more than $1 billion. The boutique coffee brand focuses on selling drinks out of small, take-out venues in business districts.

"Entry of new competitors to the specialty coffee market in China" was one of the business risks Starbucks listed in its annual report filed in November. The company has full ownership of its stores in China, giving it a greater share of the profits — and risks — from the massive market.

Guangzhou and Shenzhen have each seen thousands of coffee shops pop up in the last five years, according to data from Meituan, which runs a food delivery business and operates Dianping, China's version of Yelp.

Shanghai remains the largest coffee market, with nearly 3 shops per 10,000 people versus a ratio of about 2 for Guangzhou, Shenzhen and Beijing, according to Meituan.

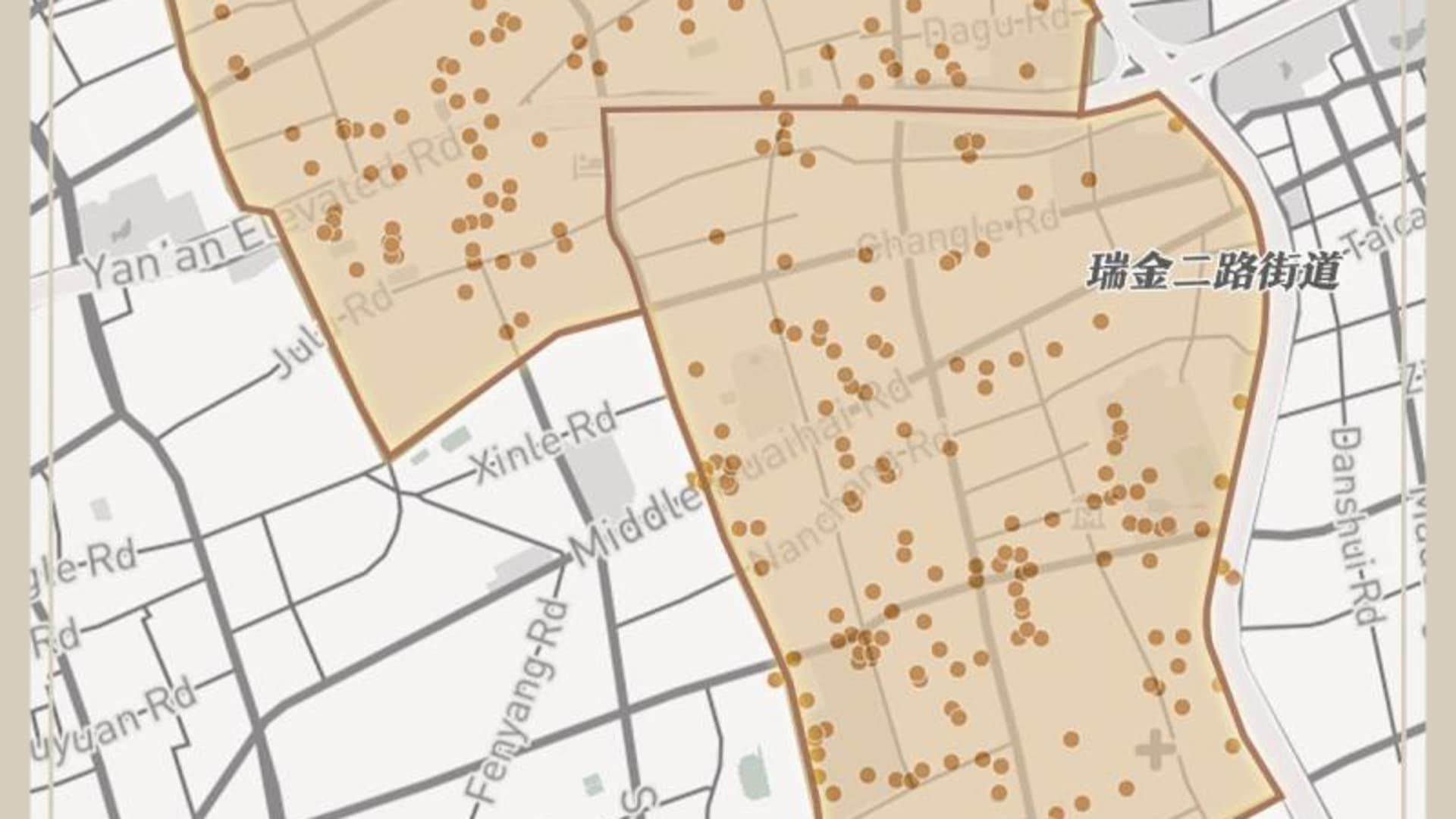

Shanghai's most dense coffee shop area

Source: Meituan, with design by Shanghai Observer

A greater market for tea in China

Starbucks retains the lead in China's specialist coffee and tea shop market with 36.4% of the market, according to Euromonitor figures for 2020.

But the market for tea drinks was twice as large as that of coffee in China and that gap is expected to expand this year, Meituan said citing industry data. The company said the number of milk tea and fruit juice storefronts is about four times that of coffee shops.

Hey Tea is second to Starbucks in China's specialist coffee and tea shop market, with an 8.8% share, according to Euromonitor. The Shenzhen-based company is best known for tea that comes with a cheese-like foamy layer of cream on top.

Hey Tea is also climbing into the global market, with a 1.1% share of the category worldwide, according to Euromonitor.