Stocks advanced on Thursday after the U.S. House passed a debt ceiling bill in a crucial step to avoid a U.S. default, with the measure now moving it to the Senate.

The Nasdaq Composite added 1.1%. The Dow Jones Industrial Average traded up 202 points, or 0.6%, despite a nearly 5% tumble in Salesforce shares following its earnings report. The S&P 500 gained 0.9%.

The Fiscal Responsibility Act passed by a vote of 314-117 with bipartisan support. Senate Majority Leader Chuck Schumer, D-N.Y., said the Senate will stay in session until a bill is sent to President Biden's desk.

Beyond the debt ceiling battle, investors are looking ahead to the Federal Reserve's June 13-14 policy meeting as another possible market catalyst. Philadelphia Fed President Patrick Harker said Wednesday that he's leaning toward skipping a rate hike at the upcoming gathering. But Friday's payrolls report could change his mind, he said.

Get DFW local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC DFW newsletters.

Data from ADP showed private payrolls grew more than economists expected in May, while the number of jobless claims filed last week was smaller than economists forecasted. The labor market has been a closely watched area of the economy given concerns that sustained strength could prompt the Fed to once again raise interest rates at its policy meeting later this month.

"A lot of the market focus is shifting from whether the government is going to default on its debts, which was never going to happen, to the more pressing issue of how much further interest rates are going to rise," said Jamie Cox, managing partner of Harris Financial.

Crypto is 'lackadaisical' as big investors wait on the sidelines for Fed rate cuts, says Galaxy's Novogratz

Money Report

Crypto may be "lackadaisical" at the moment but bitcoin and ether are still two of the best performing asset, according to Mike Novogratz.

"I don't see any urgent sellers or nervous longs, I see people that are kind of bored and stacking," he told CNBC's "Squawk Box" Thursday. "There are some sellers, but it's not like we have a leveraged market right now where people are sitting on pins and needles."

"On a risk adjusted basis, bitcoin and ether are the two best assets to invest in over two years, three years, six months," he added. "You shouldn't buy as much bitcoin as you do JPMorgan stock, but volatility adjusted it's been a much better bet than JPMorgan."

The two crypto market leaders are up 65% and 55% year-to-date, respectively, despite lower volatility in recent weeks. As soon as the Federal Reserve cuts interest rates "crypto is going to be off to the races," Novogratz said.

For more on bitcoin, check out our June outlook here.

— Tanaya Macheel

Domino's shares rise after JPMorgan calls pizza chain chain 'too cheap' in stock upgrade

JPMorgan upgraded Domino's stock on Thursday, with analyst John Ivankoe noting shares are trading at a discount compared to what the company charges for key products.

Share's of Domino's rose nearly 2% on Thursday, but are still down nearly 15% this year.

"A fresh look at estimates shows the stock as too cheap for what is a structurally low cost delivery at $6.99 for a medium 2-topping and take-out provider for a $7.99 3-topping large pizza," Ivankoe said.

Read the full story here.

— Brian Evans

Dow pares losses, flickers around flatline as Salesforce selloff cools

The Dow traded near flat and at times turned into positive territory after dropping as much as 0.6% earlier in the session. The leg up comes as Salesforce regained some ground — while still trading down around 4% — after management commentary during its quarterly earnings report disappointed investors.

Boeing, Caterpillar, Visa, American Express and Apple were the best performers in the 30-stock average, with the five all up slightly more than 1%.

— Alex Harring

Investors shouldn't chase recent rally, investing officer says

Investors should be careful about drawing conclusions about the recent strength in stocks, according to Michael Landsberg, chief investment officer of Landsberg Bennett Private Wealth Management.

He noted that almost all stocks in the S&P 500 are around flat for the year outside of a few Big Tech names. Those stocks have rallied coming off of 2022's selloff and amid growing excitement around artificial intelligence.

"The lack of market breadth is not a positive for the health of the overall market," he said.

Just three of the S&P 500's 11 sectors are trading up compared with the start of 2023. Those advancing sectors — information technology, communication services and consumer discretionary — have all gained at least 18% year to date.

Landsberg said the market is likely in a bear market rally, but the bear market itself is not over yet and investors should not chase the rally. He specifically pointed to the past two quarters of decelerating earnings, as well as the lack of breadth driving the current rally, as evidence of downside risk on the horizon.

— Alex Harring

ISM manufacturing reading holds in contraction territory

The manufacturing sector reported contraction for the seventh month in a row, though about in line with Wall Street expectations, according to a report Thursday from ISM.

ISM's Manufacturing Survey for May came in at 46.9%, representing the percentage of businesses reporting expansion. Any reading under 50% represents contraction. Economists had been looking for a reading of 47%, according to Dow Jones.

New orders fell 3.1 percentage points to 42.6% while production rose 2.2 points to 51.1%. In news that gives some hope to the Federal Reserve's inflation-fighting efforts, prices tumbled 9 points to 44.2%.

—Jeff Cox

JPMorgan raises concern over Target's outlook, downgrades stock

JPMorgan Chase downgraded Target on Thursday over concerns of a declining market share as well as disinflation in the company's grocery segment.

"Today, we believe TGT sits at the center of a number of consumer headwinds," JPMorgan analyst Christopher Horvers said. "With 51% of its sales derived from discretionary categories (apparel, hardlines, and home), 49% derived from more consumable categories (which are facing disinflation), accelerating share of wallet reversion occurring, and student loans potentially coming due, we see the risk of downward earnings revisions rising."

Last month, the company gave lukewarm forward guidance after saying sales growth could remain stagnant throughout the current quarter.

CNBC Pro subscribers can read the full story here.

— Brian Evans

S&P 500 opens little changed

The S&P 500 and Nasdaq Composite were little changed as Thursday trading kicked off.

The Dow slipped 0.2%, weighed on by a post-earnings tumble in Salesforce shares.

— Alex Harring

Shoppers are watching their spending more carefully, retail CEO are saying

"Starting in late March, demand trends weakened further in our discretionary categories," Macy's CEO Jeff Gennette said, as the company reported its latest results and took its forecast lower. The department store chain is expecting challenges to continue in the back half of the year and is making adjustments to its product assortment to reflect this stance.

It now sees same-store sales, a key retail metric, down 6% to 7.5% this year. Analysts were expecting sales to fall 2.9% this year, according to Refinitiv.

Even Dollar General, which appeals to a more value-oriented consumer, is seeing significant headwinds. CEO Jeff Owen said "the macroeconomic environment has been more challenging than expected, particularly for our core customer."

With the economic backdrop "having a significant impact on customers' speanding levels and behaviors" ahead, the retailer predicts same-store sales will be up just 1% to 2% this year, which is below the 3.5% StreetAccount estimate.

Macy's shares are down 8%, while Dollar General shares tumbled nearly 11% premarket.

—Christina Cheddar Berk, Robert Hum

Stocks making the biggest moves Thursday premarket

These are some of the stocks making the biggest moves before the bell:

- C3.ai — The artificial intelligence company sank 21% after sharing disappointing guidance for the fiscal first quarter. That overshadowed a smaller-than-expected loss for the fiscal fourth quarter.

- Salesforce — The software giant's shares fell 6% after the company reported higher-than-expected capital costs and lower demand for consulting deals in its fiscal first quarter.

- Okta — The cloud software company's shares tumbled more than 20% Thursday. While Okta's first-quarter results came above consensus analyst estimates, decelerating subscription revenue growth and smaller deal sizes from a worsening macro environment worsened investor sentiment. BMO Capital Markets downgraded shares to market perform from outperform in a Thursday note.

- Macy's – Shares of the retail giant slid 7% premarket after the company missed revenue estimates for its most recent quarter, according to Refinitiv. Macy's also slashed its full-year earnings and sales guidance, after "demand trends weakened" for discretionary items in March.

The full list can be found here.

— Hakyung Kim

Jobless claims below estimate, labor costs rise less than expected

Jobless claims edged higher last week to 232,000 but were slightly below the 235,000 Dow Jones estimate, the Labor Department reported Thursday.

Continuing claims nudged up as well, rising to 1.795 million, below the 1.81 million FactSet estimate.

A separate report showed that unit labor costs increased 4.2% in the first quarter, well below the 6% estimate. Productivity fell 2.1%, better than the 2.5% expected decline.

—Jeff Cox

Private payrolls increased by 278,000 in May, topping estimate, ADP says

Private payrolls rose by 278,000 in May, ahead of the 180,000 estimate and down just slightly from the previous month, ADP reported Thursday.

The payrolls processing firm added that job growth was "fragmented" as it was concentrated in just a few industries such as leisure and hospitality and natural resources/mining. ADP also noted that the pace of pay increases has been declining.

The report comes a day ahead of the Labor Department's nonfarm payrolls count, which is expected to show an increase of 190,000.

—Jeff Cox

RBC Capital Markets upgrades Chevron on strong balance sheet

RBC Capital Markets upgraded Chevron stock on Thursday and lauded the company's strong balance sheet and prudent acquisitions. Analyst Biraj Borkhataria added that the company should be able to better navigate a challenging macroeconomic environment compared to peers.

"Looking forward, we believe the macro environment is likely to remain volatile, however weaker end product demand and OPEC+ managing the oil market leaves CVX's upstream heavy weighting well-placed," Borkhataria said. "This combined with its fortress balance sheet and commitment to remaining disciplined through organic and inorganic activity should prove defensive over time."

Shares were up nearly 1% before the bell.

CNBC Pro subscribers can read the full upgrade here.

— Brian Evans

June has historically been a bad month for the S&P 500 and Dow

June has historically been the ninth worst month of the year for the S&P 500 and the 11th worst for the Dow, according to data analyzed by The Stock Trader's Almanac.

A typical June since 1950 brings a return of 0.1% for the S&P 500 compared with a 0.72% average gain of all months in the same time period, per The Almanac. And an average June has historically resulted in a 0.2% loss for the Dow, while the 30-stock index has advanced 0.67% when averaging all months over the same time period.

If history repeats itself, that would mean another month of below-average gains for the S&P 500, which finished May up 0.25%. It would also build on May's losses for the Dow, which ended the month down around 3.5%.

— Alex Harring

Macy's drops after guidance cut

Macy's shares dropped around 7% after the retailer slashed its revenue guidance. The company now sees full-year revenue between $22.8 billion and $23.2 billion, down from a previous range of $23.7 billion to $24.2 billion.

— Fred Imbert

RBC downgrades Exxon Mobil

RBC downgraded Exxon Mobil shares to sector perform from outperform, citing a more balanced risk-reward balance.

"XOM has outperformed most global peers over the last year, supported by strong refining margins and improving perception on the duration of its free cash flow profile," analyst Biraj Borkhataria wrote. ". Looking forward, while we believe energy markets are likely to remain volatile, the outlook for oil products and gas markets appears more mixed than was the case in 2022."

Exxon shares are down 7% year to date.

— Fred Imbert

Europe stocks open higher

European stock markets opened higher Thursday after falling to a near nine-week low in the previous session.

The pan-European Stoxx 600 index was up 0.9% at 8:40 a.m. London time, with gains across all sectors bar utilities. Media stocks climbed 1.56% as oil and gas rose 1.4%.

Germany's DAX was up 0.8% while France's CAC 40 and the U.K.'s FTSE 100 gained 0.7% and 0.5%, respectively.

— Jenni Reid

India's factory activity expands at fastest rate in 31 months: S&P Global

India's manufacturing purchasing managers' index surged to its highest level since October 2020, according to private surveys by S&P Global.

The country's manufacturing PMI came in at 58.7, higher than the 56.5 expected by economists polled by Reuters.

This is 22nd straight month that India's manufacturing sector remained in expansionary territory, and the highest in 31 months.

S&P wrote that demand conditions "demonstrated remarkable strength," with factory orders rising at the fastest pace since January 2021.

As such, S&P observed that this led to stronger increases in production, employment and quantities of purchases.

— Lim Hui Jie

China's May factory activity data shows growth, beats expectations: Caixin PMI

China's factory activity rose above the 50-mark that separates growth and contraction in May, a private survey showed on Thursday.

The Caixin/S&P Global manufacturing purchasing managers' index rose to 50.9 in May, rebounding from April's reading of 49.5.

The latest data was driven by improved production and demand, helping struggling firms that have been hit by slumping profits.

— Jihye Lee

Japan manufacturing activity expands for the first time since Oct 2022: au Jibun Bank

Japan's factory activity expanded for the first time since Oct 2022, according to a private survey.

The final au Jibun Bank Japan manufacturing purchasing managers' index stood at 50.6, snapping a six-month streak of readings below the 50-mark that separates expansion and contraction.

Tim Moore, economics director at S&P Global Market Intelligence wrote that the latest print "highlights a decisive turnaround in manufacturing sector performance," pointing at a recovery in Japan's domestic economic conditions.

This helped to lift client spending, which offset another month of subdued demand in key export markets, S&P wrote.

— Lim Hui Jie

Futures tick up after U.S. debt ceiling bill passes House vote

U.S. futures erased earlier losses after the House passed the Fiscal Responsibility Act in a late Wednesday vote.

The Fiscal Responsibility Act passed with support from both Democrats and Republicans, a dramatic conclusion to weeks of tense negotiations between the White House and Republican House Speaker Kevin McCarthy.

The bill will then go onto a vote in the Senate before heading to President Joe Biden's desk.

— Christina Wilke, Jihye Lee

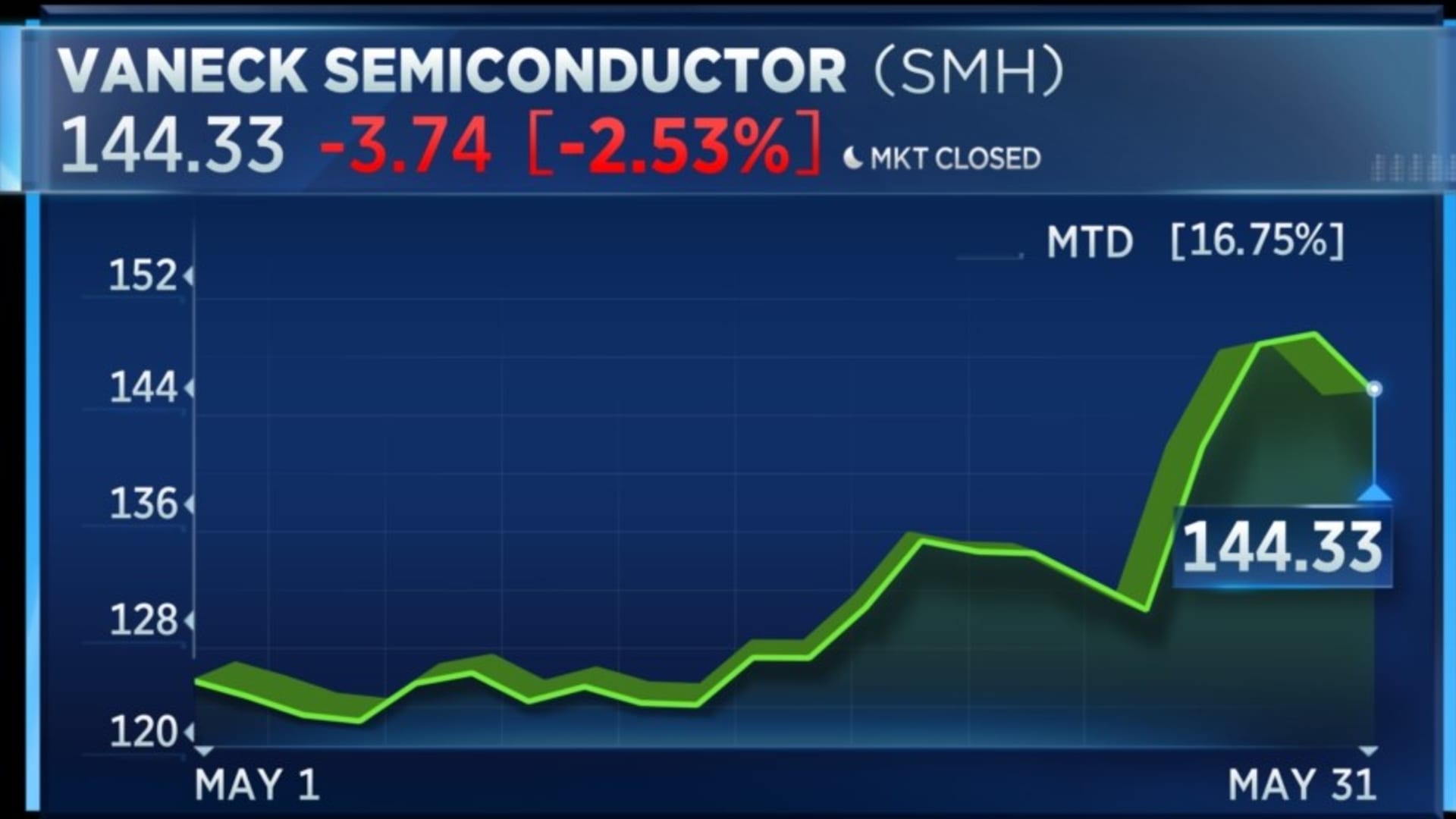

May was a hot month for tech, particularly chip stocks and growth names

The tech sector of the S&P 500 ended the month with a bang, leaping 9.29% in May as semiconductor stocks rallied.

Top gainers within the sector include Nvidia, up 36% in May, and Broadcom, which added nearly 29%. On Semiconductor gained 16% during the month.

Those names, along with their chip-making peers, helped lift the VanEck Semiconductor ETF (SMH) to its best month since January, notching a gain of 16.7%.

Nvidia is also in the iShares Russell 1000 Growth ETF (IWF), and helped catapult the fund to a third consecutive winning month and a gain of about 4.7%. It was IWF's first three-month winning streak since December 2021.

-Darla Mercado, Chris Hayes

Stocks making big moves in extended trading

Check out the companies making headlines after the bell:

CrowdStrike — The cybersecurity firm's stock tumbled nearly 12% in after-hours trading after the company reported slowing revenue growth.

Okta — Shares of the software company dropped 13% in after-hours trading despite a stronger-than-expected quarterly report. It appeared that the management's warning about increasing "macroeconomic pressures" may have been the driver that sent shares lower.

C3.ai — The artificial intelligence tech company saw its shares tumble 18% even after it beat expectations on the top and bottom lines for its fiscal fourth quarter, according to Refinitiv. C3.ai expects to see fiscal first-quarter revenue of between $70 million and $72.5 million, less rosy than the Street had expected. The stock has skyrocketed more than 250% this year amid Wall Street's enthusiasm towards AI.

— Yun Li

Stock market bears fall to lowest since January 2022 in latest Investors Intelligence survey

The percentage of bullish investment newsletter editors nudged up to 47.9% in the latest weekly survey by Investors Intelligence, from 46.5% last week, while the number of bears eased to 23.3% from 23.9%. That was the fewest number of bears since January 2022.

Those who anticipated a correction in the stock market dipped to 28.8% from 29.6%. "In general, this group usually increases as markets rally," II said. "When that occurs it may signal a trading top. Late April/early May they did the opposite – increasing as markets declined. That could portend a surprise rally."

Contrarians might take pause at this week's sentiment numbers. Rising bullishness usually correlates to greater risk that prices will decline while expanding bearishness usually signals diminishing risk. The idea is being that those who say they're optimistic are often done buying and have less cash on hand, while the reverse is true of those who say they're pressimistic.

— Scott Schnipper