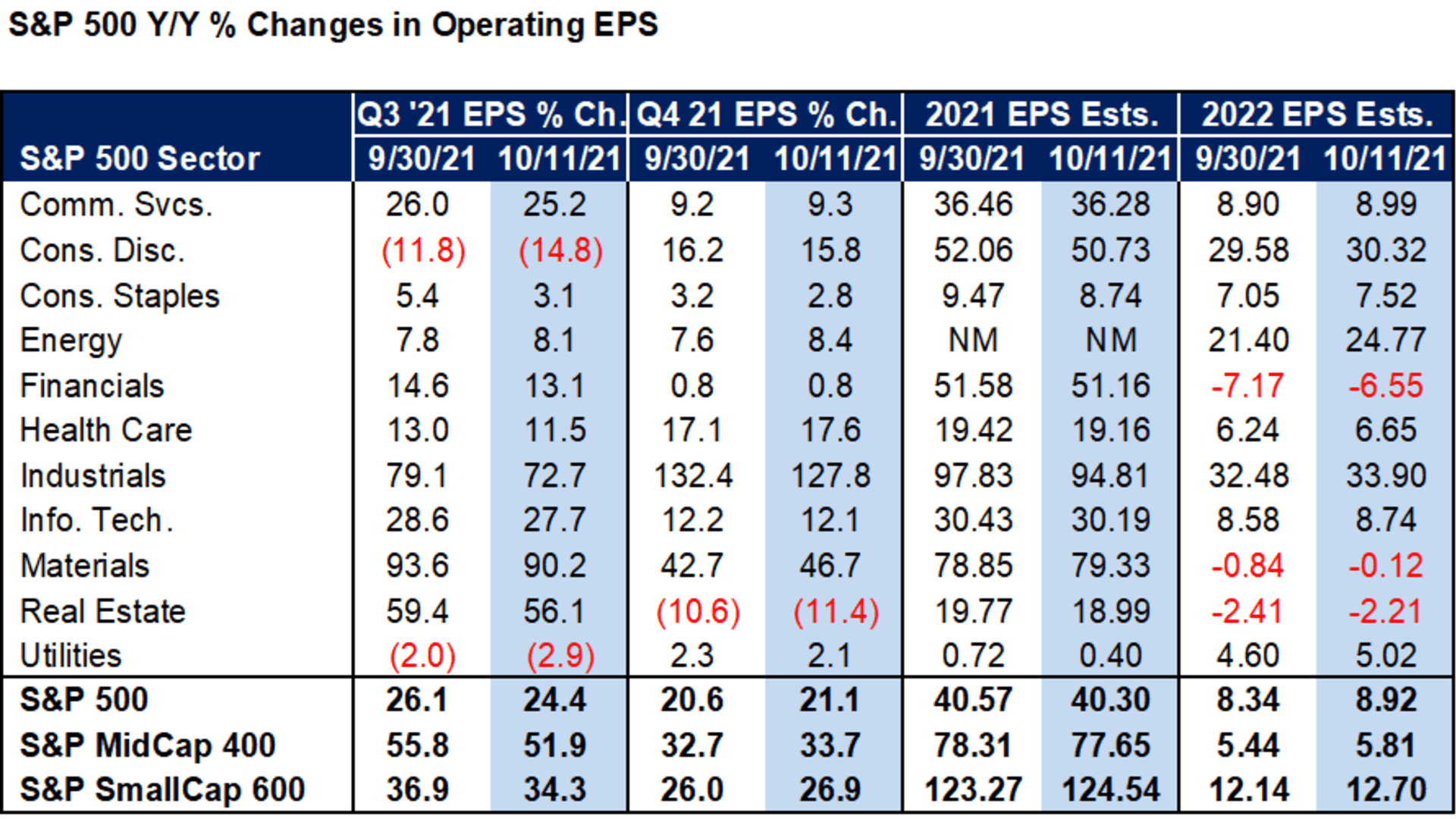

- S&P 500 earnings growth estimates have been coming down for weeks, and for only the second time in 49 quarters, the estimates have continued down even after the last quarter-end of Sept. 30 and the start of Q3 reporting.

- It is expected to be a make-or-break quarter for corporate guidance, and that really has not been the case in the massive market rebound from Covid.

- Earnings growth of 88% last quarter may represent the peak of the pandemic easy comps, and now with oil prices high, inflation and wages rising, and supply chain issues all weighing on economic growth, the level of confidence from CEOs could be the biggest factor in giving investors a reason to bid a U.S. stock market currently trading above its 20-year average even higher.

The big issue for S&P 500 earnings in the third quarter hasn't exactly snuck up on investors. The stock market has been struggling since September and the reason can be summed up in an index that is currently trading at a price-to-earnings ratio above its long-term average as many external factors, including rising commodity prices, wage inflation, general inflation, supply chain chaos, and interest rate policy become headwinds for stocks.

It was in the FedEx earnings which came out long before the major corporate earnings season started, with the shipper missing estimates by a lot, and that was after analysts had already taken estimates down in the runup to its earnings report. Making too much of any single earnings bellwether isn't a good way to think about the S&P 500, especially as it is now dominated by tech, but the fact that analysts didn't take FedEx earnings estimates down enough is notable for setting the tone for how companies come into earnings, and how different it may be this time around compared to all the other quarters since the Covid bottom.

Get DFW local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC DFW newsletters.

A make-or-break quarter for the S&P 500

In the runup to Q2 earnings, growth estimates were rising for the S&P 500. That has not been the case this time, with growth estimates continuing to fall in the weeks ahead of the major earnings that began Wednesday with J.P. Morgan. Prior to the recent negative earnings revisions, there had been nothing but increasing estimates over the last 12 months. That's one of the reasons investors don't need to struggle to understand why stocks have struggled since September. Stocks wavered on Wednesday as the latest inflation numbers, and the first big earnings of the week, came in, and after three straight days of losses.

"It was much easier to be bullish on U.S. stocks when analysts were raising estimates virtually every week, as they did up until September," DataTrek Research noted in a recent report.

Money Report

And that hasn't changed this month. Sam Stovall, chief investment strategist at CFRA Research, says usually EPS estimates have begun to outpace the end-of-quarter estimate this early in the reporting cycle, but that's not happening as major corporate earnings begin, with the S&P 500 continuing its trend of negative revisions, off by 1.7 percentage points through Oct. 11 versus Sept. 30. He cited higher-than-expected oil prices which Delta Air Lines commented on Wednesday, inflation, interest rates, and a continual lowering of Q3 GDP forecasts. Global growth continues to be downgraded as well.

According to Stovall, this may end up being only the second quarter out of the last 49 in which actual results were lower than end-of-quarter estimates.

"You invest in stocks because you want a piece of the action, and the action is earnings and dividends, and if action comes down in terms of earnings growth, that's not good," Stovall said. "We have seen 47 out of last 48 quarters (back to the second quarter of 2009); 47 out of 48 actual earnings have exceeded end-of-quarter estimates. And done so by an average of 15%," he said.

Bank of America Global Research struck a similar tone in a note this week to clients, reminding them that earnings misses are extremely rare, but it added, "the main focus will be around guidance" which has started to soften and will lead to 2022 EPS being revised lower. "We believe it will be a make-or-break quarter with all eyes on margins and supply chain," the bank's research team wrote.

Since the first quarter of 2020, which was the only miss in the past 48 quarters, earnings growth has reached as high as 88% for the S&P 500 (Q2 2021). That is now down to 25% for Q3 as major earnings hit. And Stovall said that means if the bull market continues, investors should in the least expect the angle of expected ascent to be more moderate. "Q2 could be the best quarter in terms of percentage change in earnings growth," he said. "It will continue to be positive, just positive at a smaller percentage."

Another positive way to read the earnings setup from the street: DataTrek Research still thinks analysts are too low on Q3 and Q4 earnings.

Some of the slower earnings growth is to be expected. The consumer discretionary sector is expected to post a decline of near-15%, but that is because it fell so much in 2020 after posting triple-digit advances after the Covid low: 161% in Q1 2021 and 210% in Q2 2021.

The best of post-Covid earnings growth is over

Those kinds of earnings growth numbers "can't repeat," Stovall said, and that is one reason why analysts don't want to be overly optimistic. And even as negative revisions to the S&P 500 earnings outlook hit almost every sector, especially the ones which had performed some of the biggest comebacks from Covid, including industrials, materials and consumer discretionary, Stovall stressed the earnings revisions are an indication the situation "could" be worse. Some of the sectors seeing the biggest negative earnings revisions are still expected to post significant growth. It is just up by lesser amounts.

Another way to think about it: "Investors are going through an earnings estimate realignment rather than engaging in negative earnings revisions," Stovall said. "What they are really doing is saying we are in unprecedented times, we have had tremendous GDP growth, comparative GDP and earnings growth recently, and there is still an upwards trajectory, it's just that because now we're getting past the real slump period of 2020, forward estimates are going to be less and less enthusiastic."

That comes back to what DataTrek co-founder Nick Colas says may be the difference between this quarter and every other recent quarter since the Covid outbreak — companies really need to deliver on guidance.

Investors are now in the "show me" phase of the earnings recovery, and that is a big change, especially with the S&P performance year-to-date tightly correlated with the earnings expectations: U.S. large-cap stocks received a year-long tailwind from what had been estimates that came down too much amid Covid.

The S&P 500 price-to-earnings ratio

The price-to-earnings ratio of the S&P 500 has come down, from a peak in January 2021 of over 24x to roughly 21x, but that is still a 28% premium to the average P/E ratio since 2000.

The market is already trading at a P/E ratio that is above current expectations for earnings next year. That means even if analysts end up raising earnings estimates after better-than-expected numbers, stocks may not pop because it is already expected.

What's not baked into the S&P 500 is what companies say about 2022, their margin structure given the push and pull of inflation, how much they are having to pay for labor, and other unknowns like productivity impacts from work-from-home. "A whole range of conversations, that for the first quarter since Covid, we have to get into the weeds of cost structure for companies. It is no longer the 'wow, beat by so much, that's great," Colas said.

Actual earnings estimates for the S&P 500 don't support a valuation higher than the 18x average of the past two decades and to get to a valuation of 21x, an earnings pop will be required. "Companies have had incredible earnings leverage in the past 12 months," Colas said. But now for the S&P 500 to "just crawl" into its current valuation, investors will need to be convinced there is more upside coming in 2022. "What companies say about future earnings power, particularly anything about sustainable margins, that is what will drive the market," he said. "Valuations are rich."

That is why the message Wall Street analysts and the recent market volatility are sending can be summed up in a way that is central to this earnings season: the recovery chapter for earnings, from the lows of last year, is over.

"Growth from here will be slow and choppy and subject to external shocks, so how do you put some multiple on that? That's the hard part," Colas said.

The optimistic side of the current market multiple suggests investors still believe earnings power is sustainably higher than it was pre-pandemic, and has another 5%-10% more to go in revisions higher. And that makes the outlook from here all the more important.

There are some basic things Colas is confident in saying today: No one is expecting a recession. GDP and earnings will grow. And big tech will be a bigger part of the S&P 500 a year from today.

But the right sustainable earnings growths numbers have not been a factor since the Covid bottom. They are again now, and the market won't really start again unless CEOs can convince investors that outlook is strong.

"It has not been true in the last four quarters that guidance is the most important thing," Colas said. "The earnings surprises have been so large. ... Now that stops."