Shares of GameStop pared their double-digit losses in volatile trading that occurred Monday morning after the video game retailer said it may sell up to $1 billion worth of additional shares following a historic Reddit-fueled short squeeze.

GameStop closed down 2.4% to $186.95 a share. Earlier in the day, the company saw its shares drop as much as 14% after it announced a stock offering of up to 3.5 million shares. The company said it intends to use the proceeds to further accelerate its e-commerce transformation as well as for general corporate purposes and further strengthening its balance sheet.

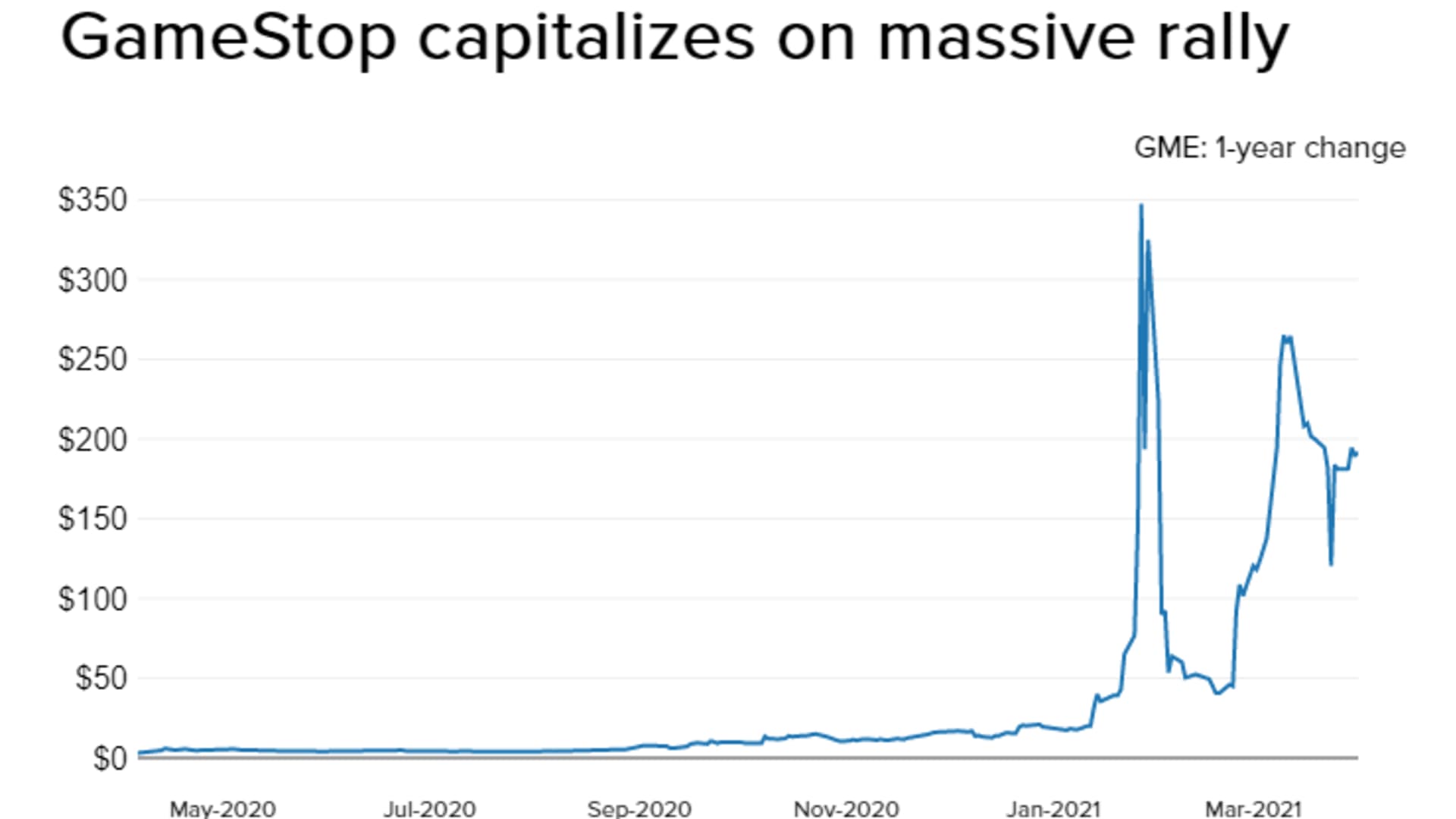

The offering is viewed as a way for the retailer to capitalize on its recent jaw-dropping rally prompted by a band of Reddit-obsessed retail traders who targeted heavily shorted stocks. GameStop surged 400% in a week in January to above $400 a share amid the massive short squeeze.

Get DFW local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC DFW newsletters.

At the beginning of the year, GameStop, a brick-and-mortar retailer, traded at less than $20 a share.

GameStop is in the middle of a technology and e-commerce transition led by activist investor and board member Ryan Cohen, who was Chewy's co-founder. The company hired former Amazon and Google executive Jenna Owens as its new chief operating officer.

Money Report

In a separate release on Monday, GameStop said its total global sales increased about 11% for the first nine weeks of fiscal 2021 from the same period a year ago. For the five-week period ended April 2, total global sales grew 18% year over year, the company said.

"The company has yet to show financial success in an industry that is rapidly shifting to digital," Joseph Feldman, analyst at Telsey Advisory Group, said in a note Monday. "We continue to believe the current valuation far exceeds our rosy fundamental expectations and projected multi-year benefits from the strategic transformation."

Two weeks ago, the company reported worse-than-expected fourth-quarter results that missed on the top and bottom lines. However, GameStop said its e-commerce sales jumped 175% last quarter and accounted for more than a third of its sales in the period.