Here are the most important news, trends and analysis that investors need to start their trading day:

- Stock futures fall as traders fret over the Fed possibly removing stimulus

- Robinhood shares drop after app warns of trading slowdown

- Wells Fargo scraps plan to end personal credit lines

- U.S. can't safely escort Americans in Kabul to the airport, Pentagon chief says

- U.S. will require nursing homes to get staff fully vaccinated

1. Stock futures fall as traders fret over the Fed possibly removing stimulus

Get DFW local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC DFW newsletters.

U.S. stock futures fell Thursday amid growing concern the Federal Reserve's stimulus removal this year could hinder the economic recovery. Futures contracts tied to the Dow Jones Industrial Average dipped 253 points, or 0.7%. S&P 500 futures dropped by 0.6%, and Nasdaq 100 futures pulled back by 0.5%. The Fed, in the July meeting minutes released Wednesday, indicated the central bank is willing to start reducing its asset purchases before year-end. Those purchases were started last year to help the economy recover from the pandemic-induced recession. Economic activity has rebounded thanks in large part to these measures. However, traders fear the economy could take another hit as Covid-19 cases are rising due to the highly contagious delta variant.

2. Robinhood shares drop after app warns of trading slowdown

Robinhood's first quarterly report since becoming a publicly traded company showed that the trading app's revenue more than doubled on a year-over-year basis to $565 million. However, its stock dropped about 11% after the company warned a slowdown in trading activity could hit revenue in the current quarter. "We expect seasonal headwinds and lower trading activity across the industry to result in lower revenues," Robinhood said in its earnings report Wednesday.

Money Report

3. Wells Fargo scraps plan to end personal credit lines

Wells Fargo has decided to keep its personal lines of credit available, reversing a decision that drew customer ire. The bank will keep the credit lines available for customers who actively use them or those who want to reactivate old ones, a Wells spokeswoman said. CNBC reported last month that the bank informed customers that revolving lines of credit would be closed following a product review. The decision also drew criticism from Democratic Sen. Elizabeth Warren, who has been critical of the banking industry and Wells Fargo specifically.

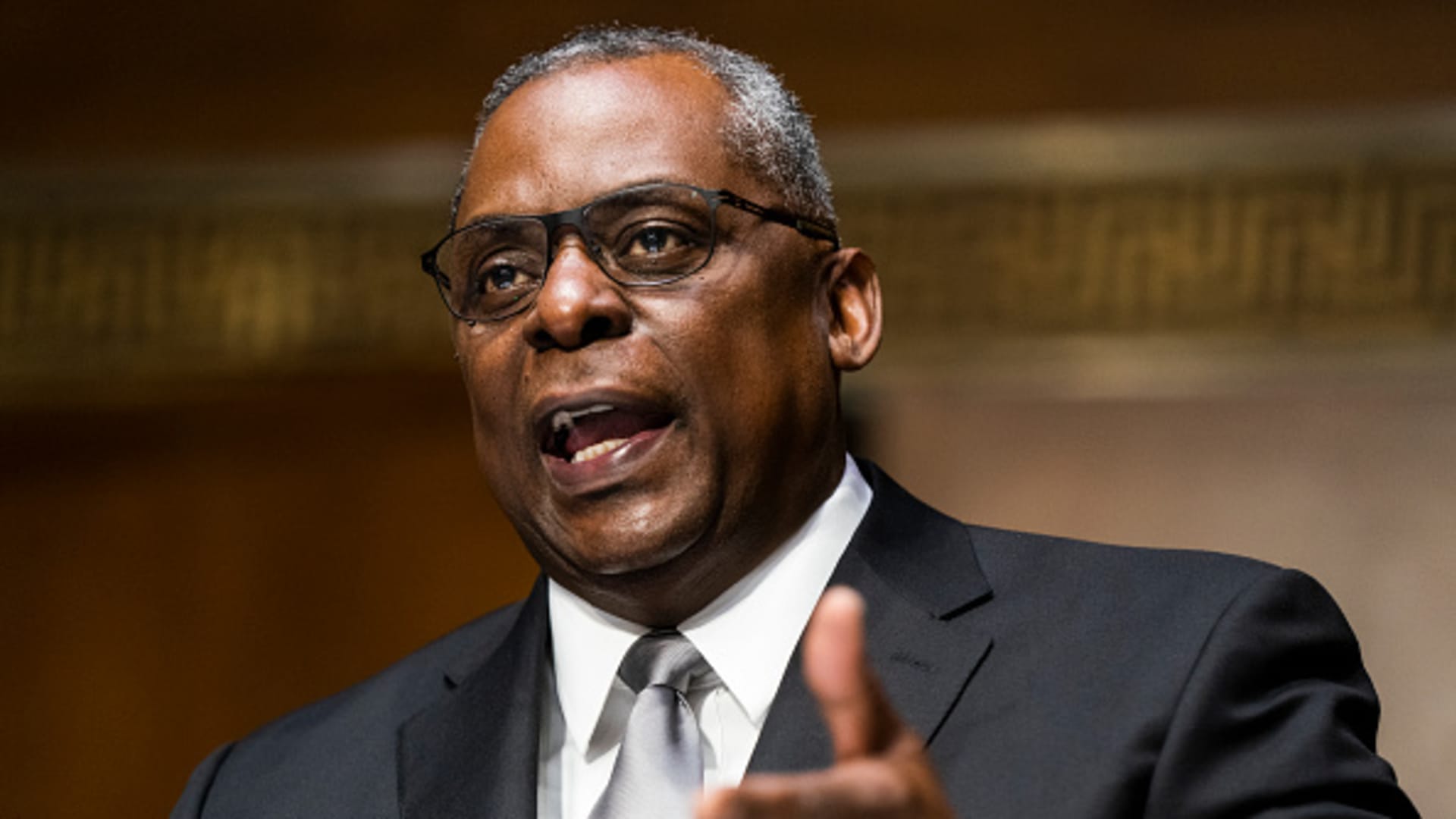

4. U.S. can't safely escort Americans in Kabul to the airport, Pentagon chief says

Defense Secretary Lloyd Austin acknowledged the U.S. can't safely escort Americans in Kabul to the airport so they can flee Afghanistan. "I don't have the capability to go out and extend operations currently into Kabul," Austin said. However, Austin did vow that the U.S. will "evacuate everybody that we can physically and possibly evacuate and we'll conduct this process for as long as we possibly can." The U.S. is relying on a deal with the Taliban to guarantee safe passage for Americans out of Afghanistan.

5. U.S. will require nursing homes to get staff fully vaccinated

A new measure presented by President Joe Biden will require nursing home staff to get fully vaccinated against Covid. "If you work in a nursing home and serve people on Medicare or Medicaid, you will also be required to get vaccinated," Biden said Wednesday. Those remarks came after an administration official confirmed to NBC News that the government will withhold funding for nursing homes that fail to get their staff fully vaccinated. The announcement comes as Covid cases around the country are rising, in large part due to the highly contagious delta variant.

— Follow all the market action like a pro on CNBC Pro. Get the latest on the pandemic with CNBC's coronavirus coverage.